Recognizing a local veteran

Nestled between Starbucks, Four Dads Pub, and Beman True Value Hardware in the center of Granby stands 18 Hartford Avenue, a single-family home built in 1927 that now houses a multi-million-dollar company known as Squadron Capital.

Employing nearly 550 people, Squadron invests in companies with revenues in the range of $10-$100 million dollars. The man behind Squadron Capital’s success is CEO Dave Pelizzon.

“Service” has been a keyword of Dave Pelizzon’s life. In 1973, at age 17, Pelizzon joined the army to serve his country, and after completing basic training he became a helicopter mechanic. From there, Pelizzon studied at West Point with a concentration in weapons systems engineering. This intensive program, with classes six days a week, exposed him to topics ranging from math, physics and chemistry to courses in propulsion, helicopter engineering and rocket engines. “I remember sophomore year,” Pelizzon notes, “I had physics, math and chemistry all before lunch. And then had classes after lunch. I’m not sure I could do that now.”

After amassing 162 credit hours, Pelizzon graduated from the United States Military Academy at West Point in 1981 and moved into a commission in the infantry. As a member of the 82nd Airborne Division, Pelizzon served as a lieutenant for about 18 months.

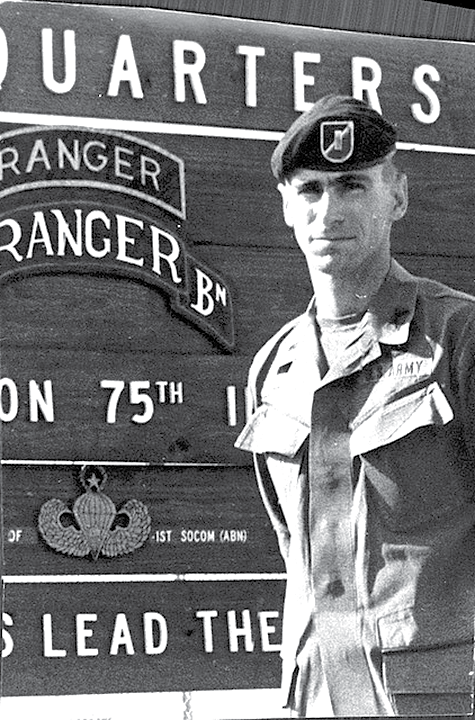

From there, he moved to the first Ranger battalion at Hunter Army Airfield, where he started becoming exposed to special operations. In October 1983, Pelizzon parachuted into Grenada and was “one of the first guys on the ground there.”

As a capstone to his impressive military career, Pelizzon enrolled at Harvard for graduate school. This education catapulted him into roles at the Pentagon. In service to the United States military, he travelled to Alaska for a year, served in special operations at Fort Bragg, and was a member of Central Command on 9/11. During his military career, Pelizzon also earned an advanced degree from the United States Naval War College. “I thought the Naval War College was a better intellectual experience than Harvard, actually,” he remarks.

In 2003, after 30 years in the military, Pelizzon retired. “I was very fortunate; I had a great time. I’m glad I did it,” he reminisces. The skills he acquired during his military service career translated directly into a strong business acumen. He turned his attentions to an industrial cutting tool company out of Pittsfield, Mass. Even though he did not have a manufacturing background, Pelizzon became very successful.

He credits this in part to the leadership skills he developed in the army. “Out of the military, I had so many leadership opportunities, everything from leading a platoon [of 20-50 people] to leading a battalion of 700 people, with all kinds of vehicles and weapons. I found that a lot of civilian companies totally lacked any type of leadership.”

This emphasis on leadership would become key to Pelizzon’s success. As he notes, in many companies “the leadership was flawed. Leadership was removed from the people working on the floor; they didn’t understand what they were doing.” By providing strong leadership, Pelizzon found that he could increase the efficiency of a company and guarantee its success.

Pelizzon’s venture into industry and manufacturing would lay the groundwork for what would eventually become Squadron Capital. After two and a half years, Dave expanded into medical and surgical technologies, and in June 2008 Pelizzon founded Squadron Capital. Squadron grew rapidly, acquiring stakes in a wide variety of companies ranging from pediatric orthopedics to optics and specialty nanofilms to plastic molding.

Despite the large number of companies Squadron Capital is involved in, Pelizzon can describe the function, mission and products of each in detail. He provides guidance, resources and leadership to Squadron Capital’s portfolio companies, while still being “hands-off” and allowing the companies to run themselves.

One of its oldest acquisitions is OrthoPediatrics, a company based out of Warsaw, Ind., whose mission is the design and manufacture of pediatric orthopedic implants and instruments. Since Squadron Capital’s involvement in 2014, the company has grown to be worth nearly $700 million dollars. Similarly, Alphatec Spine (part of Alphatec Holdings), which Squadron Capital has committed financing to since 2018, has grown from being worth $100 million dollars to now over $2 billion dollars.

Even in light of his financial success, service has remained a key part of Pelizzon’s life. Each year, Squadron Capital donates nearly $1 million dollars to numerous charitable causes, which have included an orthopedic fellowship at Boston Children’s Hospital, the American Cancer Society Bucket List Bash, and Whitefish Veterans. Locally, Squadron Capital supports the Simsbury Fly-In, the Farmington Valley YMCA’s summer camps and the Waste Not Want Not Community Kitchen, among others.

Local events and organizations like these, Pelizzon observes, make Granby and the Farmington Valley a great place to live. Squadron Capital’s largest donation to date, to the Farmington Valley YMCA, stems from the desire to support the community atmosphere. “An organization like the Y is really critical to assisting families; it’s part of the fabric of the community,” Pelizzon affirms. “To me it’s almost as important as the school system because it provides a lot of activities and a lot of functions that support the town, and especially families.” These activities not only promote exercise, healthy eating and volunteer opportunities, they also encourage the next generation to develop leadership skills—skills that Pelizzon has found critical to his success.